Aftermath Report

Rootstock.io generously provided a grant for the pilot Turbocharging Rootstock’s Stablecoin Liquidity Campaign to enhance liquidity within the ecosystem.

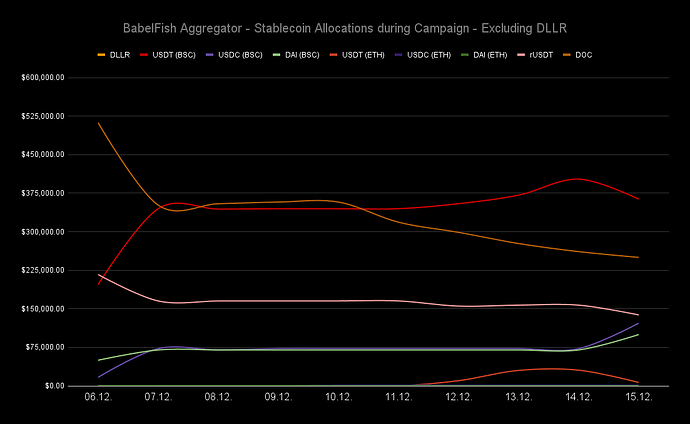

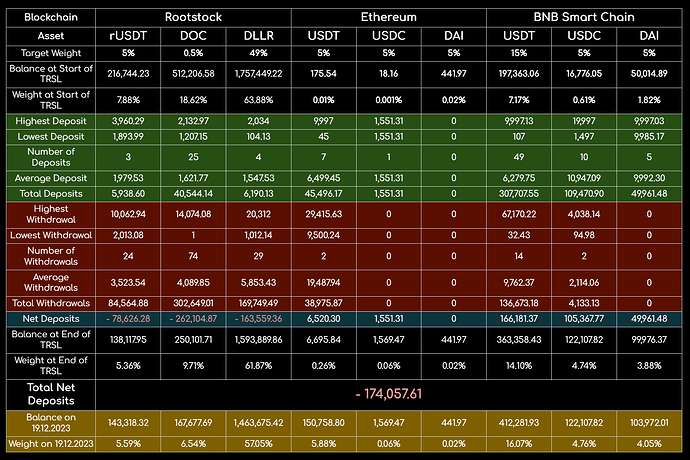

Campaign Period: December 6th, 2023 - December 15th, 2023

A total of $ 5,000 worth of stablecoins were allocated for user incentives. 4,000 XUSD was allocated to the BabelFish Balancing Curves Reward Manager, and 1000 XUSD for rewarding random users who complete the user journey.

Incentives (4,000 XUSD) were sent to the BabelFish’s Balancing Curves Reward Manager at block #5875054: Tx 0x3d4d309f7b5424b84347127f058d35a853fd4ffac882a5c40473cc60d10457cb. It included a small amount of XUSD from the old Reward Manager Smart Contract.

Turbocharging Rootstock’s Stablecoin Liquidity pilot campaign key takeaways :

- Balancing Curves with its Reward Manager - with a very limited amount of incentives provided to the Reward Manager - proved excellent efficiency in terms of balancing stablecoin allocations and driving BSC and ETH stablecoin liquidity to the Rootstock ecosystem.

- Total inflows of BSC and ETH stablecoins: $ 339,232.90.

- Achieving diversified and closer to Target Weights stablecoin allocations. It improved even further (until 19.12.2023 - date of preparing this document).

- Volume increased by 414%.

- Collected Network fees increased by 347%.

- Number of TX’s increased by 452% (434%*).

- Number of unique wallets interacting with BF Aggregator increased by 220%.

- Number of unique wallets interacting with the BF Reward Manager increased by 240%.

- Most of the initial 4,000 XUSD was utilized within the first 24 hours of the campaign.

- Conversion fees (Balancing Curves Imbalance Fee) collected by Reward Manager: 4,208.92 XUSD.

- Total Incentives provided to users by Balancing Curves Reward Manager: 8,208.92 XUSD.

- Most single user (wallet) transactions - 45.

- Highest incentive for single deposit - 312.29 XUSD.

- Total incentives for single user (wallet) - 7,282.75 XUSD.

- Highest deposit: 19,997 USDC on BSC.

- Highest withdrawal: 67,170 USDT to BSC.

- Most withdrawals were in DOC, which initially exceeded target weight by 18.12%.

- Very high demand for DLLR - highest average withdrawals for Rootstock native stablecoins.

- Total liquidity was reduced by withdrawals of Rootstock stablecoins by $ 174,057.61

- Effective Balancing Curves incentives and penalties oscillated around 2%.

- Adjusting of Balancing Curves Factor Parameter is required.

- Number of form submissions - 2. Users are not interested in sharing data which can help to identify them.

- 200 XUSD is allocated to users who completed the user journey.

- 800 XUSD will be provided to the Reward Manager, as it could drive additionally at least $ 32,000 worth of stablecoins which are below Target Weights.

- BUSD from BSC and RDOC from Rootstock were paused during the campaign.